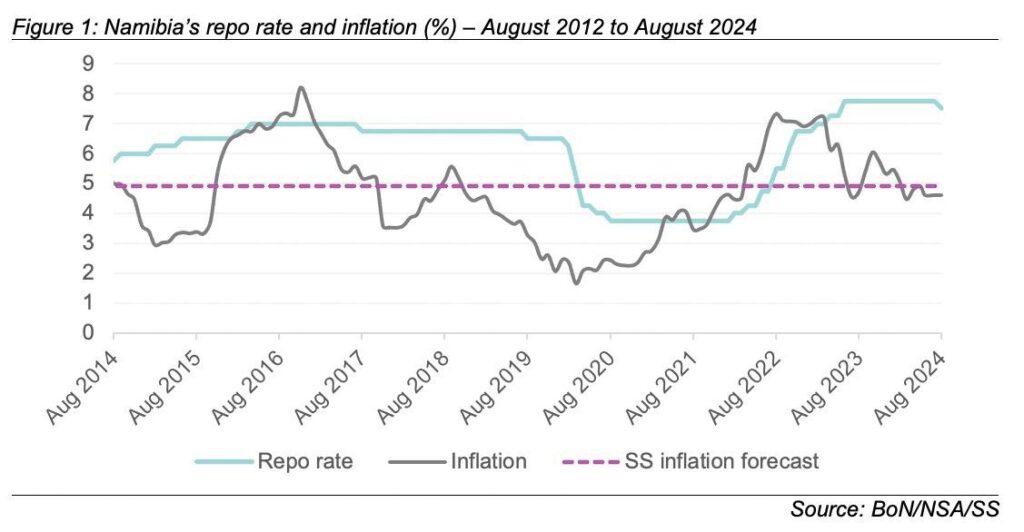

The Bank of Namibia’s fourth monetary policy announcement of the year took many by surprise, as the central bank opted to reduce the interest rate by 25 basis points, lowering the repo rate to 7.50% and the prime rate to 11.25%. This marks the first rate cut since the hiking cycle began in June 2022, positioning Namibia 75 basis points behind South Africa. While the rate remains relatively high, this decision offers some relief to Namibian households and businesses by reducing borrowing costs. Our initial expectation was for rates to remain unchanged, with a potential cut later in the year. However, the Bank of Namibia chose to act sooner.

The reduction in the repo rate is expected to lower borrowing costs across the economy, potentially revitalizing private sector credit extension, which has been subdued in recent months.

This move could stimulate economic activity as businesses and households gain confidence in a less restrictive monetary environment. Looking ahead, we anticipate further rate cuts in 2024, including an additional 25 basis points reduction towards the end of the year. Such continued easing of monetary policy is likely to support sustained economic growth, with GDP projected to reach 3.6% in 2024 and 3.8% in 2025.

As we transition into 2025, Namibia’s economic growth is expected to be driven primarily by three key sectors: tourism, consumer spending—bolstered by improved credit conditions due to lower interest rates—and mining. These sectors are set to benefit from the more favorable monetary environment, which is expected to persist as rates continue to decline. The anticipated rate cut at the end of 2024 should further ease borrowing costs, supporting both consumer demand and business investment, thereby fostering broader economic expansion.

Regarding the currency outlook, we project the Namibian Dollar to trade at 18.30 to the US Dollar by the end of 2024, with a slight appreciation to 18.10 in 2025. This forecast reflects a relatively stable currency environment, underpinned by prudent monetary policy and improving economic fundamentals. The expected appreciation in 2025 aligns with Namibia’s broader economic recovery, driven by growth in key sectors and favorable external conditions. Currency stability will likely bolster investor confidence and contribute positively to the broader economic landscape as the country navigates global economic uncertainties.

In South Africa, the economic outlook is cautiously optimistic. The newly formed government is creating favorable conditions for economic recovery, with significant progress observed in Operation Vulindlela. While challenges remain, particularly with Eskom and Transnet, there are signs of improvement, although the path to full resolution is likely to be lengthy. Growth in South Africa is expected to remain subdued in the near term. However, we anticipate that potential rate cuts in September 2024 and in 2025 could stimulate the economy, benefiting both consumers and businesses. These developments are expected to have a positive spillover effect on Namibia, particularly through trade and investment channels.

In conclusion, while challenges remain, the combination of monetary easing, sectoral growth drivers, and currency stability positions Namibia for a favorable economic outlook in 2025. With careful monitoring of inflation risks and strategic policy adjustments, the economy is poised for sustained growth as the year progresses, supported by a robust foundation in key sectors and a stable currency.

Simonis Storm is known for financial products and services that match individual client needs with specific financial goals. For more information, visit: www.sss.com.na