A NAMIBIAN BOARDROOM PERSPECTIVE

The increased interest from investors and stakeholders and the expectation that Boards become more engaged, knowledgeable and effective has resulted in increased usage of Board evaluations as a tool to measure and enhance the effectiveness of Boards.

Background

In 2019, Deloitte Namibia carried out a corporate governance survey with participants from various company sectors such as private, public and state-owned enterprises. The survey was intended to assess the maturity of corporate governance in Namibia, including, amongst other areas, conducting Board evaluations, risk management and cyber security. In this article, we will unpack some of the survey results pertaining to Board evaluations of corporate entities in Namibia.

Introduction

The increased interest from investors and stakeholders and the expectation that Boards become more engaged, knowledgeable and effective has resulted in increased usage of Board evaluations as a tool to measure and enhance the effectiveness of Boards.

The execution of Board evaluation exercises has become best practice pursuant to the development of contemporary corporate governance frameworks in the 2000s. Most commonly, Board evaluations are carried out on four dimensions as per the below image1 derived from the Committee of Sponsoring Organisations of the Treadway Commission, and their effective use can objectively elicit valuable and candid feedback, which in turn can provide a basis for the identification of training needs for directors and in motivating why re-appointment of directors may or may not be appropriate (NamCode principle C2-22.5)

1. The attributes of effective Boards

The majority (82%) of our respondents conduct Board evaluations, but still experience persistent concerns about Board effectiveness that seem to indicate that the results of the evaluation are not being used for effective improvement. In light of this, this article aims to ascertain how corporate entities in Namibia can best use Board evaluations as a tool to effect increased Board performance and explores key areas of deficiencies as self-reported by our respondents.

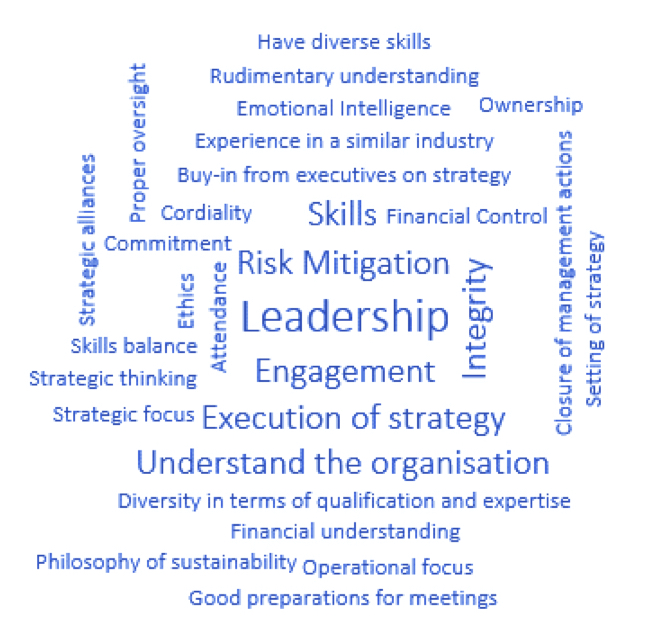

We asked our respondents to list the top three criteria for effective Boards and highlight their responses in the Word cloud below. It is clear from the responses that entities are increasingly expecting their Boards to show high commitment to the business, bring leadership and strategic direction and provide a balance of skills, while at the same time demonstrating tact and emotional maturity. With this expectation being the benchmark for effective Boards, a Board evaluation becomes an invaluable tool in measuring and adjusting performance and can provide targeted insight for individual Board members.

2. What comprises a value-adding Board evaluation?

The function of a Board of directors is to ensure that the entity’s processes and strategic choices are optimised to maximise the benefits derived from operating while optimising costs and risks.

The successful functioning of the Board to achieve this objective relies upon the codification of the role, functions, duties and performance criteria of the Board in Board and subcommittee charters, prioritising elements to be evaluated within the dimensions and communicating this effectively across the organisation. The dimensions of Board evaluations illustrated in the graphic above have been developed to address the various processes and considerations a Board should put in place to successfully discharge their duties.

Our survey highlighted the inclusion of the below thematic areas covered in Board evaluations in corporate entities in Namibia:

Most often, strategic, leadership and financial considerations are included in the evaluation of Boards. These areas can be considered traditional concerns for entities and, while providing valuable insight to Boards, may be considered low-hanging fruit or assessing items already known to be strengths of the Board and therefore limited potential for improvement exists. While it is of value that these areas are included in the evaluation, emphasis needs to be placed on the fact that any weaknesses identified during the evaluation should be addressed with clear actions and the success of such actions should be measured during the next evaluation cycle.

Least often, the positioning of the Board in the organisation, the Board’s drive for innovation and other criteria such as the preparedness of Board members for and contribution to meetings are evaluated. These areas are emerging strategic concerns for enterprises in Namibia as we move into an increasingly global and highly competitive market with threats to established methods of conducting business coming from unexpected quarters. The ability of the Board to anticipate such threats and proactively direct the entity towards a strategy of resilience is directly proportional to its effectiveness, which, in turn, depends on consistent, timely availability of performance information.

3. How often is often enough when evaluating Boards and who should evaluate the Board?

For companies planning their first Board assessments or to build on the previous ones, the pressing question might be how often should the Board of directors be evaluated? NamCode principle C2-22 recommends that the Board, its committees and the individual directors be evaluated for performance annually, but leaves the form of the evaluation to be assessed for value of the Board.

Our results highlight the below distribution for evaluations:

Board evaluations conducted by an external party are preferred by the majority (46%) of respondents, which is aligned to best practice, as self-evaluations can suffer from lack of in-house expertise and experience and results can be negatively influenced by the power differential between the Board members receiving the feedback and the person(s) conducting the review. The objective perspective from outside the enterprise allows for constructive feedback and value-added suggestions, as the external reviewer can provide benchmarking data not only from past evaluations of a particular entity but also across entities within the same industry or across specific other categories of information upon request. There is also no risk that the results are influenced by internal dynamics amongst Board members.

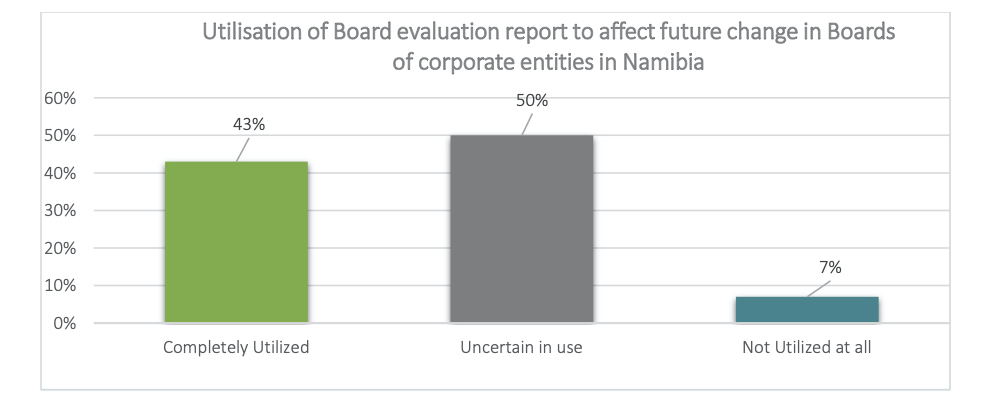

An advantage to using a reputable external evaluator is that this person can provide an independent and objective perspective to the Board and the entity’s operating environment. This ensures that the contents of the report are not a tick box exercise (as seems to be the case for the 7% of respondents not using the report at all), but rather form an integral part of the strategic activities the Board undertakes to discharge its duty. The Board is well within its right to expect that performance evaluations provide insight rather than simply summarising and anonymising criticism.

4. How should a Board evaluation report be used?

Although it is clear that Namibian entities understand and actively seek alignment with provisions such as NamCode principle C2-22.6, which requires the disclosure of whether an evaluation has taken place in the integrated report, uncertainty exists amongst Boards as to the value that the report is supposed to provide (see graph below).

Survey results have revealed the following pertaining the utilisation of Board evaluation report results to affect future change:

Part of the problem may be that weaknesses identified during the evaluation may not be tracked with clear actions, action owners and due dates for implementation and evaluations are insufficiently tailored to take into account conscious structural decisions made by the Board.

While the approach to a Board evaluation as highlighted above is a standard one, the contents of the Board effectiveness report should always be tailored to the relevant entity, its Board and unique operating circumstances and strategy and should clearly set out achievable actions for the entity and Board to take to strive for excellence.

Conclusion

We have seen an increased spotlight on the performance of Boards both by shareholders as well as the general public and have noted that generally, Boards take their duties very seriously, so it is surprising that Board evaluations are not yet consistently used to enhance Board performance, as a feedback loop is clearly essential in ensuring continued strategic adjustment and relevance in an increasingly fast- paced and volatile environment.

While Board evaluations are relatively widely used, their effectiveness as a tool to drive increased performance is not yet fully ingrained in the market. Increased insistence by Boards and management on annual evaluations can help improve this situation, for as long as Boards ensure that appropriate, clear remediations are put in place subsequently to receiving a Board effectiveness report. Often, these actions are already documented in the Board effectiveness report, but are side-lined throughout the year until just before the next Board evaluation. Assigning action owners responsible for enforcing implementation may drastically increase the value derived from Board evaluations.

CONTACTS:

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited (“DTTL”), its global network of member firms, and their related entities (collectively, the “Deloitte organization”). DTTL (also referred to as “Deloitte Global”) and each of its member firms and related entities are legally separate and independent entities, which cannot obligate or bind each other in respect of third parties. DTTL and each DTTL member firm and related entity is liable only for its own acts and omissions, and not those of each other. DTTL does not provide services to clients. Please see www.deloitte.com/about to learn more.

Deloitte is a leading global provider of audit and assurance, consulting, financial advisory, risk advisory, tax and related services. Our global network of member firms and related entities in more than 150 countries and territories (collectively, the “Deloitte organization”) serves four out of five Fortune Global 500® companies. Learn how Deloitte’s approximately 312,000 people make an impact that matters at www.deloitte.com.

This communication contains general information only, and none of Deloitte Touche Tohmatsu Limited (“DTTL”), its global network of member firms or their related entities (collectively, the “Deloitte organization”) is, by means of this communication, rendering professional advice or services. Before making any decision or taking any action that may affect your finances or your business, you should consult a qualified professional adviser.

No representations, warranties or undertakings (express or implied) are given as to the accuracy or completeness of the information in this communication, and none of DTTL, its member firms, related entities, employees or agents shall be liable or responsible for any loss or damage whatsoever arising directly or indirectly in connection with any person relying on this communication. DTTL and each of its member firms, and their related entities, are legally separate and independent entities.

© 2020. For information, contact Deloitte Touche Tohmatsu Limited.