It is probably quite normal to first move into a state of panic when threatening things catch you by surprise. A potential next step, when the dust has settled and we can think more clearly, is to focus on what we can do. Finally, we sometimes find comfort in realising that we are not alone and that others are faced with similar struggles.

In a previous article for WestAir I provided a template for navigating through these uncertain times that COVID-19 has brought upon us. The template looked at Income Statements and Balance Sheets and focused on the levers that we can pull, in other words, it focused on what we can do. I think it is imperative that we don’t move too quickly to the other stage of finding comfort in the fact that we think others might be in the same boat. We should rather focus on what we have control over and make peace with what we don’t. The well- known quote “Grant me the serenity to accept the things I cannot change, the courage to change the things I can, and the wisdom to know the difference” applies.

Why do I say we must focus on what we have control over?

- The only period with sufficient data that is analogous to what we are going through now, is probably the depreciation years of the 1930s/1940s – we all know how painful that was.

- Not all governments, not all businesses and not all individuals are equal.

COVID-19 has arrived when the world was already highly indebted. Ray Dalio talks about the long-term debt cycle that throughout history typically took 75-100 years to peak. We are close to the peak of such a cycle, and the holes that COVID-19 has made to Income Statements and Balance Sheets have to be filled by taking on more debt.

Some countries have more fire power or are perceived to have stronger Balance Sheets to fill these holes through monetary (printing money) and fiscal (spending) policy. The United States, although highly indebted, are in the enviable position where 55% of the world’s reserve currencies is in USD. That means that on a relative basis there should still be demand for USD the unprecedented stimulus that America is undertaking. Should you live in Emerging Markets with a currency that doesn’t have reserve status, printing money will exacerbate the weakness many emerging market currencies have seen during this crisis, as it will increase the supply of money when there is no particularly high demand (prices are determined by supply and demand). History suggests that if you go through such a time and you don’t have reserve currency status, the pain will be more severe.

Unfortunately, Namibia falls in this category and we would be wise to prepare ourselves for a potential deflationary depression. In other words, a period where we will be forced to go through a deleveraging process in which we have to cut expenses and reduce our debt, and this might mean that you are forced to sell assets when you don’t want to. Therefore, focus on what you have control over and cut expenses in advance, be creative in generating income, and diversify your assets wisely. If you can find someone that you can trust, test your opinions. This might just help you to soften the blow – I don’t believe we are all in the same boat.

Unfortunately, Namibia falls in this category and we would be wise to prepare ourselves for a potential deflationary depression. In other words, a period where we will be forced to go through a deleveraging process in which we have to cut expenses and reduce our debt, and this might mean that you are forced are all in the same boat.

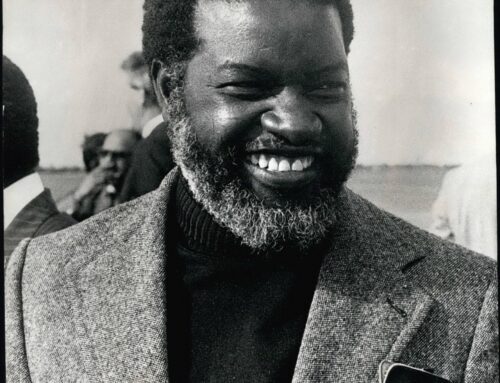

By René Olivier (Managing Director of Wealth Management)

René Olivier (CFA) is the Managing Director of Wealth Management at IJG, an established Namibian financial services market leader. IJG believes in tailoring their services to a client’s personal and business needs. For more information, visit www.ijg.net.